Diversify & Secure Your Portfolio With Bond-Backed Litigation Funding

Diversify & Secure Your Portfolio With Bond-Backed Litigation Funding

Imagine a world where litigation funding opens doors to justice for deserving claimants while intelligently diversifying your investment portfolio.

15% Target Distribution Yield

100% Principal Protected

Exclusive U.S. Rights

Experienced Team

Positive Social Impact

Leveling the Playing Field. Empowering Claimants

15%

Preferred Return

5 Years

Capital Hold

100%

Principal Protection

Imagine a world where litigation funding opens doors to justice for deserving claimants while intelligently diversifying your investment portfolio.

At BlackSwan Capital Partners, we step into the British legal arena to support consumers who have been mis-sold loan agreements or have valid business energy claims. This opportunity isn't just smart; it generates positive social impact and shapes a brighter future where justice prevails and investments flourish.

Why Invest with BlackSwan Capital Partners?

High preferred returns (15%+):

You’re not relying on lofty projections that will never come true, but you can count on predictable returns on capital.

100% Principal protection:

We ONLY take on projects that are backed with surety bonds to offer our investors protection on their principal for cases that aren’t won.

Uncorrelated to stock & real estate markets:

The world of litigation financing is totally independent of different markets and the economy as a whole and this leads to maximum investment diversification.

Our Competitive Advantages:

Exclusive U.S. litigation funding rights via UK law firm partnerships to reduce market competition and hedge and allow us to offer a premium return to our investors.

Principal protection through surety bonds for risk reduction on your investment.

15%+ preferred returns with no management fees. That way, you receive more of your capital back without having to pay the traditional 2%/20% management fee.

Capitalizing On A Vast & Growing Market:

The global litigation funding market is projected to reach $37.5B by 2028. Our exclusive rights uniquely position us to capitalize on this huge growing market.

Solving The Problem of Unequal Access To Justice: We provide funding to empower claimants to pursue valid legal claims they otherwise couldn't afford. This removes financial barriers and promotes a more equitable legal system.

Our Intelligent Funding Solution: By financing meticulously vetted legal cases, we enable monetary recoveries for both claimants and investors. Justice is served and investment profits are earned.

Outperform the Market. Leverage Litigation Financing Funds.

Create Wealth

Investing in BlackSwan Capital’s Fairness Fund 1 helps generate wealth for our investors by providing uncorrelated growth potential and principal protection so you can ensure your investment is going in the right direction.

Uncorrelated Diversification

When you invest in BlackSwan Capital, you are putting your money to work across dozens, if not hundreds, of legal cases, so maximize your diversification. You’re also investing in a totally uncorrelated asset class that is independent of market and real estate fluctuations.

Principal Protected

Our principal-backed promise places surety bonds against the risk of cases going wrong. While you might not see an upside in this scenario, your principal is protected, andyour capital is diversified across dozens, if not hundreds, of cases.

Drive Impact

Experience the power of legacy wealth-building while helping solve the real-world problem of winning cases never being heard simply due to high costs.

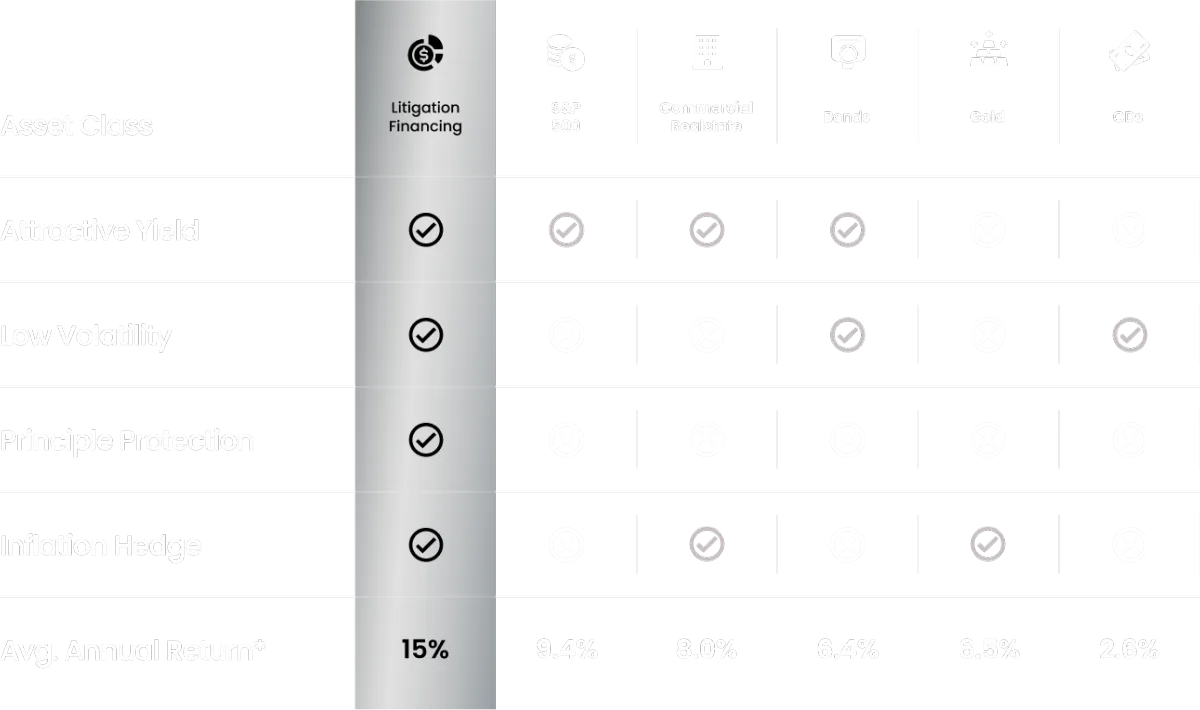

So, How Does Litigation Finance Compare to Other Investments?

Discover why litigation financing is one of the smartest investments available.

Meet Your Performance-Obsessed Team With Decades Of Operational Excellence.

◎ TRACK RECORD

Headquartered at One World Trade Center, we hold exclusive U.S. litigation funding rights through esteemed UK law firm partnerships. We are positioned to allocate $5M monthly to cases currently, expanding to $10M/month as we add new law firm partners. Within 3 years, we target $100M deployed.

◎ PROVEN APPROACH

Our highly-differentiated model invests in a pressing public need that will last for decades to come. Litigation financing has been around since the 1990s and is rapidly expanding in the markets that we are targeting.

Today, the U.K. litigation finance market appears poised to continue growing. While data can be hard to come by, according to the 2018 Burford survey of law firm and in-house lawyers, 63 percent of U.K. respondents report “their organization’s use of legal finance has increased in the last two years.” One estimate places its size at 5 percent of the global market with the large number of top firms located in the country providing additional upside. The largest potential market for litigation finance of civil litigation, however, remains the United States.

◎ STRATEGIC FOUNDER

Anthony Cibotti is a highly experienced financial and business professional with a remarkable track record in managing substantial assets and advising prestigious firms. Anthony has successfully overseen assets totaling over 2 billion dollars for well-known companies including Merrill Lynch, UBS, and Northern Trust, particularly focusing on high net worth offices.

Throughout his career, Anthony has demonstrated a unique ability to identify and build successful “off the run” strategies in alternative finance. Anthony's proficiency in this area has made him a valuable strategist to numerous organizations.

Anthony holds advanced financial degrees from Harvard Business School and Oxford University.

Let's Answer Your Questions

Who is this for?

BlackSwan Capital Partners is for accredited investors seeking to diversify their portfolios with uncorrelated alternative investments while making a positive social impact. If you're interested in earning above market returns by investing in litigation funding, we'd love to talk with you.

What makes you different?

We hold exclusive U.S. litigation funding rights through our partnerships with top UK law firms. What makes our investment approach unique is our use of surety bonds which provide 100% principal protection. While this protection reduces returns, we believe the 15%+ net distribution yield still creates one of the best risk return profiles available to investors anywhere.

How do you help solve the problem of unequal access to justice?

We provide funding that empowers claimants to pursue valid legal claims they otherwise couldn't afford. Removing financial barriers promotes a more equitable legal system where justice is served regardless of economic status. Our investments make a real difference in people's lives.

What kind of cases would I be invested in?

Our UK law firm partners have a proven track record in consumer claims, especially in areas like mis-sold loan agreements and business energy claims. We carefully vet each case to optimize for both financial returns and social impact.

Do I need to be accredited?

Yes, you must be accredited as defined by the SEC—An individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.a person whose individual net worth, or joint net worth with that person's spouse or partner, exceeds $1,000,000, excluding the person's primary residence.

What is the minimum investment?

Our minimum investment is $100,000. Higher investment tiers offer enhanced preferred return rates.

What target distribution yield should I expect?

Target distributions range from 15%-25% depending on the amount invested.

How long will I be invested?

The fund term is five years, with a one-time option to redeem after year 3.

Is the team experienced?

Our team brings extensive experience from prestigious institutions such as Harvard, Oxford, Merrill Lynch, UBS, and Northern Trust.

Are there management fees?

Black Swan does not charge management fees for this strategy.

I’m interested. How can I get involved?

If you're ready to explore this opportunity further, click below to book your call now. We look forward to connecting!

Invest In Justice. Elevate Your Returns.

BlackSwan Capital Partners: One World Trade Center, NYC

Disclaimer: Offer only available to accredited investors. Risks are fully detailed in the Private Placement Memorandum. Past performance is not indicative of future results.

Invest In Justice. Elevate Your Returns.

BlackSwan Capital Partners: One World Trade Center, NYC

Disclaimer: Offer only available to accredited investors. Risks are fully detailed in the Private Placement Memorandum. Past performance is not indicative of future results.